Property searches in Ghana have come a long way over the last decade. Five to ten years ago the typical property search involved either a visit to the offices of an estate agent, newspaper adverts or friends as a source of information. The introduction and development of online platforms like Meqasa and Tonaton has quickly transformed the way most people in Ghana search for places to live. Their growing share of the search market is now a valuable source of data that we can use to track key metrics and trends.

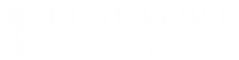

Meqasa, the leading property platform in Ghana, has given us access to their proprietary data and infographics on land prices broken down by area for the period 2018 to 2019 (see table 1 below). The volume of online searches on the Meqasa platform hit 10.9m last year with a corresponding 33% growth in property postings to 21,000. We believe that the platform has garnered enough traction to make their data significant in assessing overall market trends in Ghana.

An immediate caveat to be aware of is that Meqasa’s data only captures asking prices (offer prices) by landlords and homeowners and not actual closed transaction prices. In the UK the gap between “asking” and “closing” prices is typically around 5% due to discounts (Zoopla 2019) and negotiations. Based on our experience in Ghana, this gap could be between 10% to 20%. Nevertheless the data is useful in highlighting overall trends. This data can help us confirm or challenge our assumptions around property prices around Accra.

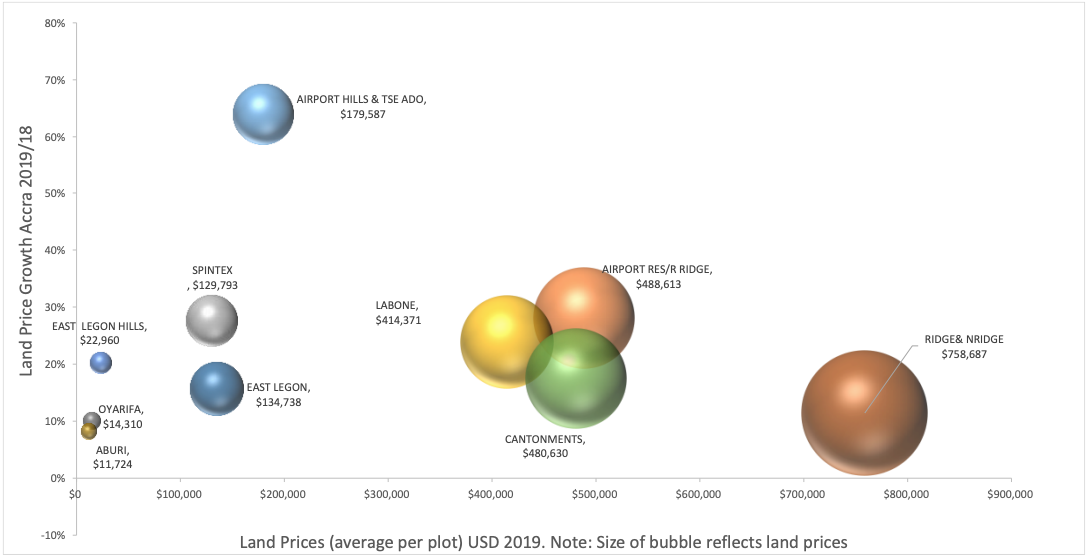

Public perception and discourse usually focuses on Cantonments and Airport being the most expensive areas. However, property postings by agents and landowners put Ridge and North Ridge areas as the most expensive. The area has become the main financial and commercial node as well as the headquarter location for some of Ghana’s blue-chip corporates like MTN, Ecobank, Standard Chartered and IMF. Average asking prices for this area was GHS 4.4m per plot (equivalent of $750,000 per plot or $3.8m an acre). This compares to Cantonments at $480,000, East Legon at $135,000 and Oyarifa at $14,000 per plot respectively.

Table 1: Land Prices in GHS 2018 & 2019

Outer areas: Growth not as dynamic as expected

A surprising observation is the lack of clear correlation between property price growth and how expensive the land currently is. Prior to seeing the data, our assumption was that one would see slower capital appreciation in already expensive areas whilst emerging areas on the periphery would experience “catch up” growth. For instance, Airport Residential still witnessed 28% growth in cedi terms, whilst Oyarifa only witnessed 10% growth. Growth in Aburi seems to have stalled with 8% growth.

Airport Hills is the biggest outlier with 64% growth year on year from GHs 635,906 in 2018 to GHs 1,041,607 in 2019. We don’t believe the Airport Hills Gated Community itself is seeing these sort of price escalations but rather it’s a case of “location hype” on the part of sellers when advertising. The new Burma Camp road has transformed the accessibility of areas around the Airport Hills development and its possible new areas like Tse Addo and East Airport have been classified within the Airport Hills description. Nevertheless, these are emerging areas and the dramatic change in accessibility means they are areas to watch. Their ability to compete with East Legon or Cantonments will be further shaped by planning policy discipline and proximity to neighbourhood amenities. Outside of this area, growth across Accra seems to be fairly consistent, with most areas hovering around the market average over the period. Macroeconomic and population growth is lifting the entire land market but local specific factors have boosted a limited number of areas as demonstrated by Airport Hills and Tse Addo.

On a local currency denominated basis, average property prices in Accra grew at 24% in 2019 (Ghana CPI inflation was 9.4%). If you factor in cedi depreciation of over 12.9% as at December 2019, then land in Ghana is doing its job as a decent hedge against both inflation and currency depreciation. However, we believe differences in land prices will start to be accentuated by differences in types of land tenure regimes (Private, Stool or State), changes in accessibility from transport investment and a little dose of Ghanaian hype. Institutional investors and large developers will continue to pay a premium for titled Government Land and in the absence of periphery areas speeding up and cleaning up land registration processes, the price catch up of the outer areas will be limited.